Since I discovered disposable virtual cards, I have not considered any other way to pay for my online purchases.

Nowadays, great concepts prevail when talking about technology: safety and comfort. These two concepts take on even more prominence if we take it to our finances and make online purchases..

In this scenario, online banks have expanded their services, offering various options to manage our money efficiently and, at the same time, secure our purchases on the Internet.

Nowadays, most banks in Spain give you the possibility of creating virtual cards to make online purchases. This adds an additional layer of security, especially when making transactions from mobile phones and the famous NFC.

However, to give you an idea, traditional physical or virtual cards have the same information in each transaction.

If this information is compromised, there is an increased risk of fraudulent use. Additionally, a security breach on a website can compromise card information and put all future transactions at risk.

So, What happens when we want to buy from completely unknown websites or without any prior reference that doesn’t look very good? This is where single-use or disposable virtual cards come into play, curious friends that offer us an additional level of security and that I was unaware of until recently.

The magic of disposable virtual cards: Revolut on top

As their name implies, these virtual cards only have one lifespan: Once used, a new card is automatically generated with different numbers and data. This idea guarantees you an additional layer of security, as if we were using a different physical card for each purchase.

The real magic of these cards can be seen when purchasing from websites we don’t know or haven’t visited before. In the event that the platform suffers a security breach, the bank details associated with the disposable card are of no use.since the card becomes invalid after a single transaction.

Until now, The neobank Revolut – the one I have tried so far – has led this new movement by offering the function of disposable virtual cards. In addition to the standard virtual card, Revolut allows you to generate single-use virtual cards, giving you a new number with each purchase made.

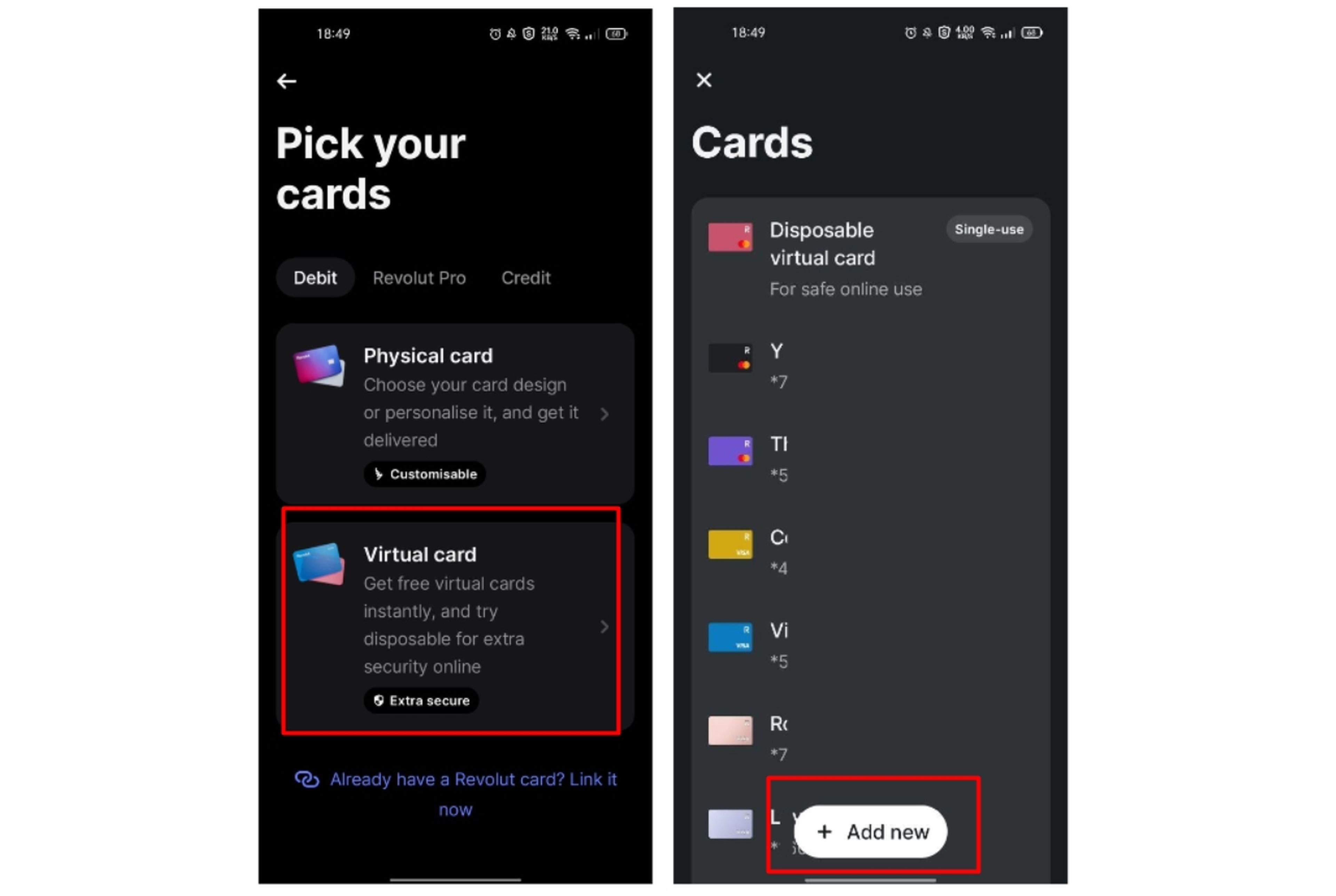

After registering and activating your account, you can easily access the Cards feature from Home. When you select the Get cards and Virtual card option, you will see that the Disposable virtual card option appears below.

The process is as simple as making a purchase– We load the necessary amount of money onto the virtual card and, once the transaction is completed, the card becomes inactive. If another purchase is required, we simply generate a new card.

Furthermore, they are not only a smart solution for online shopping, but They also offer an additional level of security for fixed payments, such as platform subscriptions. By generating a new set of data with each use, these cards ensure that your transactions each month are backed by an extra layer of protection, which never hurts.

However, there are other options for those looking for more security in their online transactions. Prepaid cards, veterans in the financial world, are also an alternative to consider. Independent and unlinked from the main bank account, these cards offer versatility and compatibility with NFC payments from mobile phones.

Nevertheless, Neobanks are gaining ground in this space thanks to their flexibility and advanced security options. The trend indicates that disposable virtual cards, with their unique focus on security, are displacing reloadable prepaid cards.