The new 2023-2024 Income campaign is taking shape just a few weeks after its start. The Tax Agency (AEAT) already allows taxpayers to obtain the reference number, essential to access the draft and be able to submit the procedure.

The code will allow the necessary procedures for this and previous campaigns to be carried out, the AEAT has reported. The reference number from other years is no longer validso it is mandatory to obtain a new one, the agency has warned. “From March 12, 2024, the references obtained during the 2022 campaign cease to have effect”Explain.

The Tax Agency has made available to citizens a new number that can be obtained from the application or the web portal with this link.

ComputerToday

The process is simpler if taxpayers have the information from the previous campaign’s tax return on hand. People They will only have to enter their ID and the data from box 505 of the previous year’s declarationaccording to The vanguard.

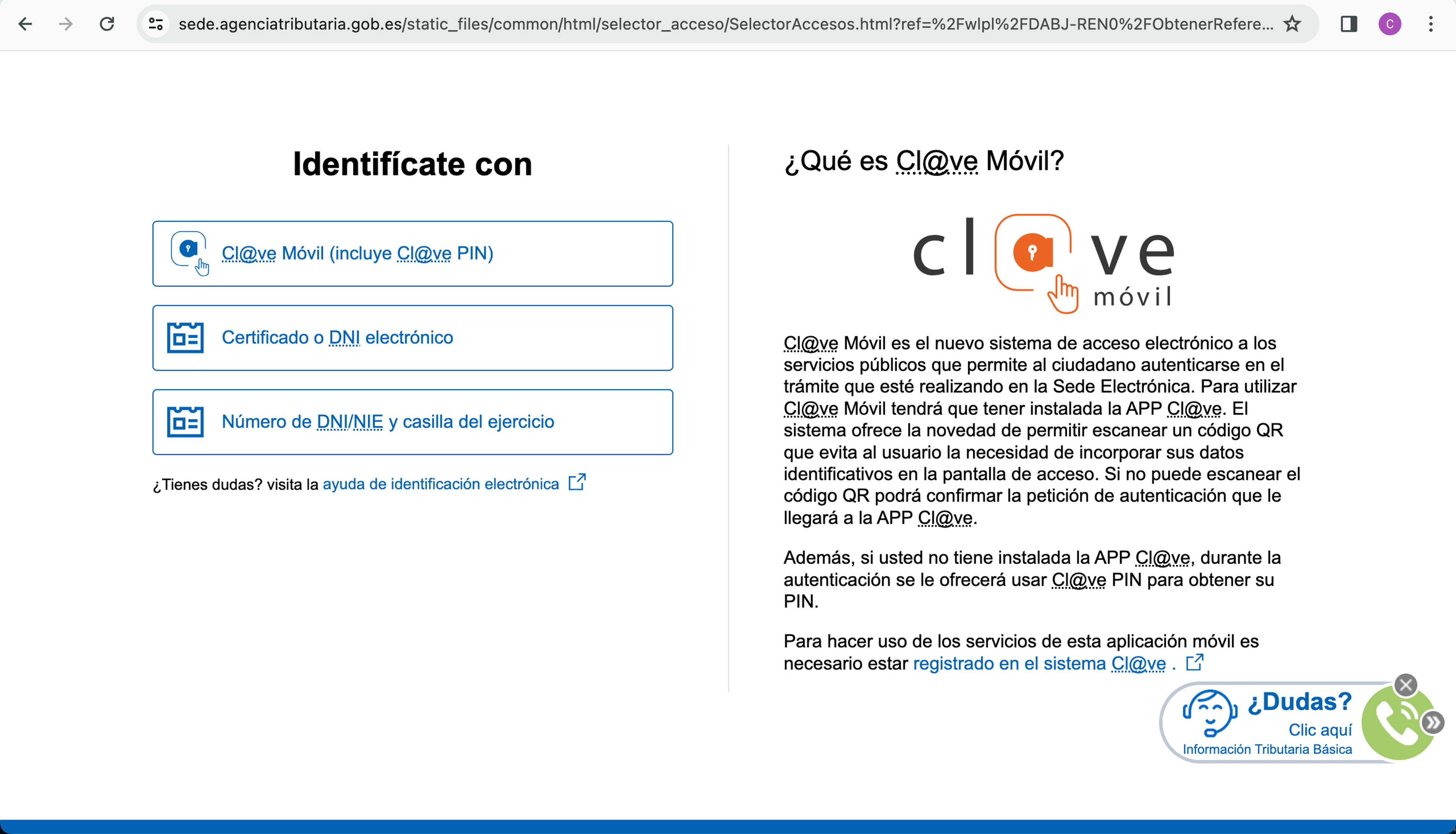

Another slightly faster option to obtain the reference number is by identifying yourself in the Tax Agency app or website using Cl@ve, one of the ways to officially register with the tax authorities. The Treasury explains the steps to follow according to the situation of each taxpayer and their initial registration method.

Tax agency

Key dates of the 2023-2024 Income campaign

The calendar of the Income Tax campaign was announced a couple of months ago by the Tax Agency. This year does not have too many new features beyond the fact that the start date is brought forward compared to previous years. The 2023-2024 personal income tax declaration starts this April 3 and ends on July 1.

Prior appointments and deadlines for direct debit also change slightly compared to other years, so there are some key dates that citizens have to mark in red on their calendar:

- April 3: The Income Tax campaign officially starts, you can consult the draft and start filing the return regardless of the result.

- April 29: Those who need help with the personal income tax return may make an appointment to be assisted by phone. The Tax Agency’s telephone help service will answer taxpayer queries from May 7 to June 28.

- May 29: Those who need it may make an appointment to be attended to in person at one of the offices of the Tax Agency and its collaborating entities. In-person help will be available from June 3 until the last appointments for July 1.

People who want to be assisted by the Tax Agency will have to inform by telephone or in person and request an appointment, either online or by telephone.

The income campaign ends on July 1, but people who have results to deposit will have until June 26 at most if they use direct debit payment. Taxpayers who submit returns late could face penalties.